Great Barrington Property Taxes Due Feb. 1

Property tax payments for the third quarter of FY22 are due Feb. 1. Residents also have the option of making their fourth-quarter payment now or by May 1.

Tax bills were mailed in late December and early January.

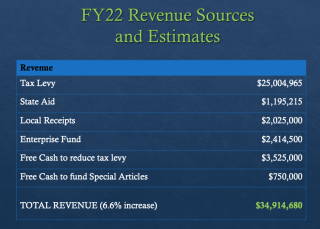

{Image: Approximate numbers for FY22 town revenue sources]

This year’s property tax rate is $14.86 per $1,000 of property valuation, down from $15.99 last year. The average tax bill rose $230 this year, over FY21.

The FY22 tax bills are sent twice during the fiscal year, in July and December/January.

The July bills reflected estimated taxes, since the town’s tax-setting process was not complete until later in 2021. The current bills reflect final property values for FY22.

Anyone with a concern or question regarding their property assessment may contact the Assessor’s office at (413) 528-1619 ext. 2302. Residents can also file a tax abatement application deadline by Feb. 1, at 4 p.m., and the abatement application can be found on the Assessors page of the town website, here.

Payments can be made online on the Town Hall website, or by check or by cash. Cash payments must be made in person at Town Hall.