Watch Your Mail: Great Barrington Tax Bills Being Mailed Soon

Real estate and personal property tax bills for the 2023 fiscal year will arrive in taxpayers’ mailboxes around July 1.

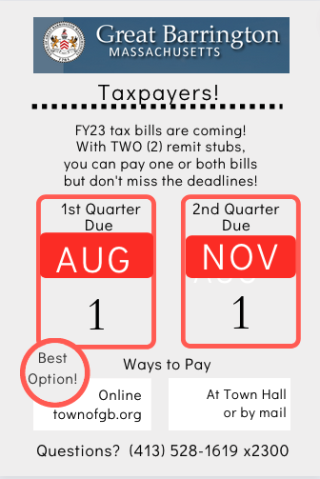

The mailing envelope includes two remittance slips: One for the first quarter of FY23, with a payment deadline of Aug. 1. Another is for the second quarter payment and is due Nov. 1. Taxpayers can pay both bills at once (Aug. 1) or separately (Aug. 1 and Nov 1), but both payment deadlines must be met. Missed payments result in interest and penalty fees.

Taxpayers are advised that no 'reminder' notice will be mailed for the second quarter, Nov. 1 deadline.

The July 1 tax bills are labeled as “preliminary” since the first and second quarter tax bills are based on the estimated FY23 tax rate, which will be set in the coming months.

In late December, third and fourth quarter “final” bills for FY23 will be mailed, based on the final FY23 tax rate. The January envelopes will contain remittance slips for a Feb. 1 due date (third quarter) and a May 1 due date (fourth quarter.)

Again, property owners may pay both quarters at once or separately, but deadlines must be met to avoid interest and penalty fees.

Town Manager Mark Pruhenski reminds taxpayers that the quarterly payment option was implemented during Covid-19 to allow taxpayers more flexibility during a financial hardship period. This system, common in many towns across the state, also provides more consistent revenue for the town.

Tax bills can be paid online at townofgb.org or dropped off at Town Hall. For customers choosing to pay by U.S. mail, the town utilizes a Boston-based “lockbox” address in order to expedite the processing of checks sent in the mail. These U.S. mail details are contained in the tax bill.

Taxpayers with questions about their assessed property values, tax abatements, exemptions or mailing address changes should contact the Assessor’s office, at (413) 528-1619 ext. 2300.